Insights

Fed Adopts Cautious, Data-Driven Approach

The Federal Reserve delivered a 25-basis-point (bp) rate cut in the December FOMC meeting, bringing total cuts to 100 bps over three months. However, the Fed signaled greater uncertainty about the timing and extent of further cuts, reflecting hawkish revisions to its SEP economic projections for 2025 and beyond.

Highly anticipated ‘skip’

In an anticipated move, the FOMC has unanimously maintained the federal funds rate target at 5.00-5.25% for the first time since January 2022. Despite holding rates steady, the market responded strongly to raised 2023 projections. Fed Chair Powell emphasized a deceleration in the pace of hikes, contrasting with the increased projections, causing market reactions to fade. The complex macro environment and potential risks of a sluggish growth and weaker earnings outlook due to the ongoing tightening cycle are key considerations.

Peak rate in excess of 5%

The recent meeting of the Federal Open Market Committee (FOMC) went largely as expected. The committee raised interest rates by 50 basis points. FOMC raised the projection for the peak rate in 2023 by 50 basis points to 5-5.25%. Interestingly, the median inflation projections also rose despite better recent inflation news. The market is pricing in two additional rate hikes of 25 basis points each in February and in March, resulting in a peak rate of around 5%.

Largest hike in almost 30 years

The FOMC delivered a 75bp rate hike at its June meeting, the largest hike since 1994, and raised the target range for the federal funds rate to 1.50% – 1.75%. The Fed appears strongly committed to tame inflation. Fed Chair Powell began the press conference by reiterating that the Fed has both the tools and resolve to deal with inflation. The risk of inflation expectations becoming de-anchored is obviously concerning for policymakers.

Inflation is like toothpaste

The US core CPI came in above consensus showing that US consumer prices climbed 7.5 per cent in the year to January. Equity markets fell following the data, prompting speculation of the Federal Reserve rapidly raising borrowing costs. There was even chatter about an emergency rate hike over the weekend after St. Louis Fed President Bullard’s comments stating his desire to "see 100 basis points" of hikes by July and commenting the possibility of the Fed being open to an inter-meeting rate increase. On back of all of this sent the yield on the benchmark 10-year Treasury note above 2 per cent for the first time since 2019.

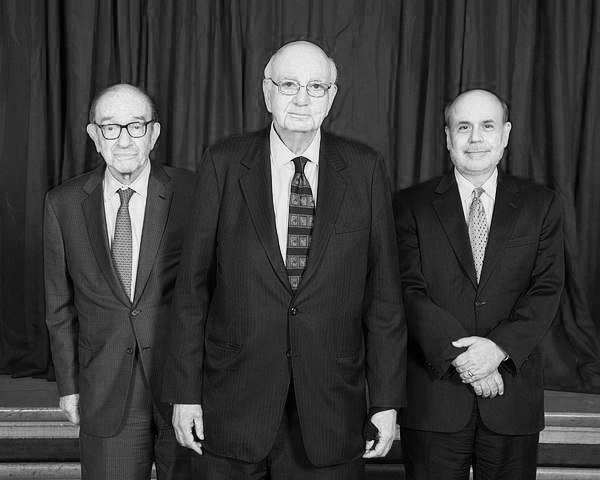

Volcker hiked 200 bps on a Saturday night

The reaction function of the FOMC has changed. Chairman Powell said in a testimony during his Senate confirmation hearing that he thinks inflation poses a sever threat to the economic recovery. He also noted that he now sees controlling inflation as the path to full employment. This is a a decided change from the view before the December FOMC. It would appear the Fed is looking to restore its credibility in the battle against inflation as well. A hawkish global monetary pivot is underway.

FOMC: Not yet ready for rate hikes

The FOMC delivered the much-anticipated announcement on tapering in the November meeting. The committee indicated that "similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook."

Tapering “may soon be warranted”

In its statement on Wednesday, FOMC provided advance notice that tapering “may soon be warranted”, as widely expected. This suggests that the FOMC will likely announce the start of tapering at its November meeting, as we have expected for some time.